Introduction: The Hidden Volatility in Your Back End

For the franchise car dealer, the Finance & Insurance (F&I) department is the indispensable profit engine, often bridging the margin gap created by tight front-end profits and rising inventory carrying costs. You push for strong PVR (Profit Per Vehicle Retailed) targets, but how much of that profit is truly secure?

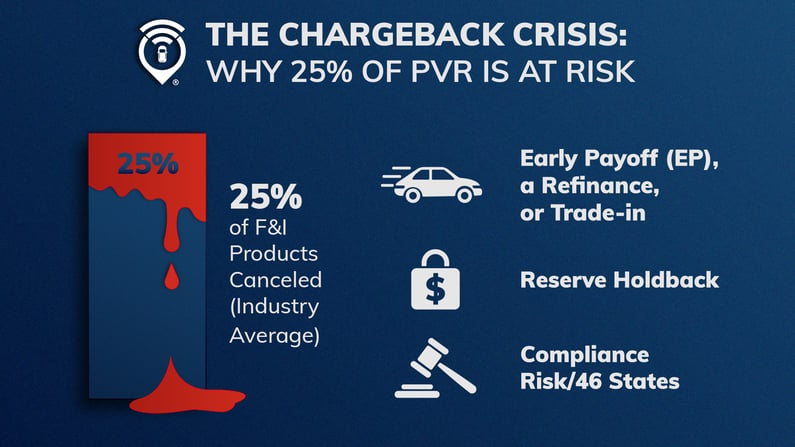

The reality is stark: while you book that F&I PVR at the point of sale, industry data indicates that a significant percentage - often reaching 25% or more in some portfolios - ends up getting canceled (Source: AFSA: American Financial Services Association). 🚫

This high volatility is known as the chargeback crisis. An early payoff (EP), a refinance, or a trade-in triggers a mandatory refund, debits your reserve account, and silently erodes the profit you thought you earned. Ikon Technologies Stolen Vehicle Recovery & Connected Car program is fundamentally structured to eliminate this risk, creating a non-cancellable revenue stream that stabilizes your bottom line and creates reinsurance eligibility for the program's limited theft warranty.

The Silent Killer of F&I Profit

Your reliance on cancellable F&I products introduces structural instability and significant regulatory exposure.

Traditional products like Vehicle Service Contracts (VSCs) and GAP waivers are legally classified as service contracts. This classification means:

- Mandatory Refunds: 46 states mandate timely and accurate refunds for canceled products. Failure to administer these refunds properly exposes the dealership to severe compliance risk, fines, and litigation.

- Reserve Holdback Penalty: Lenders often implement a 75/25 calculation, holding back 25% of your income in reserve accounts as protection against anticipated chargebacks. This ties up essential working capital that should be on your general ledger.

If your PVR is dependent on cancellable products, you are constantly paying an unpredictable tax on your profit.

The Hard-Add Defense: PVR Protection by Design

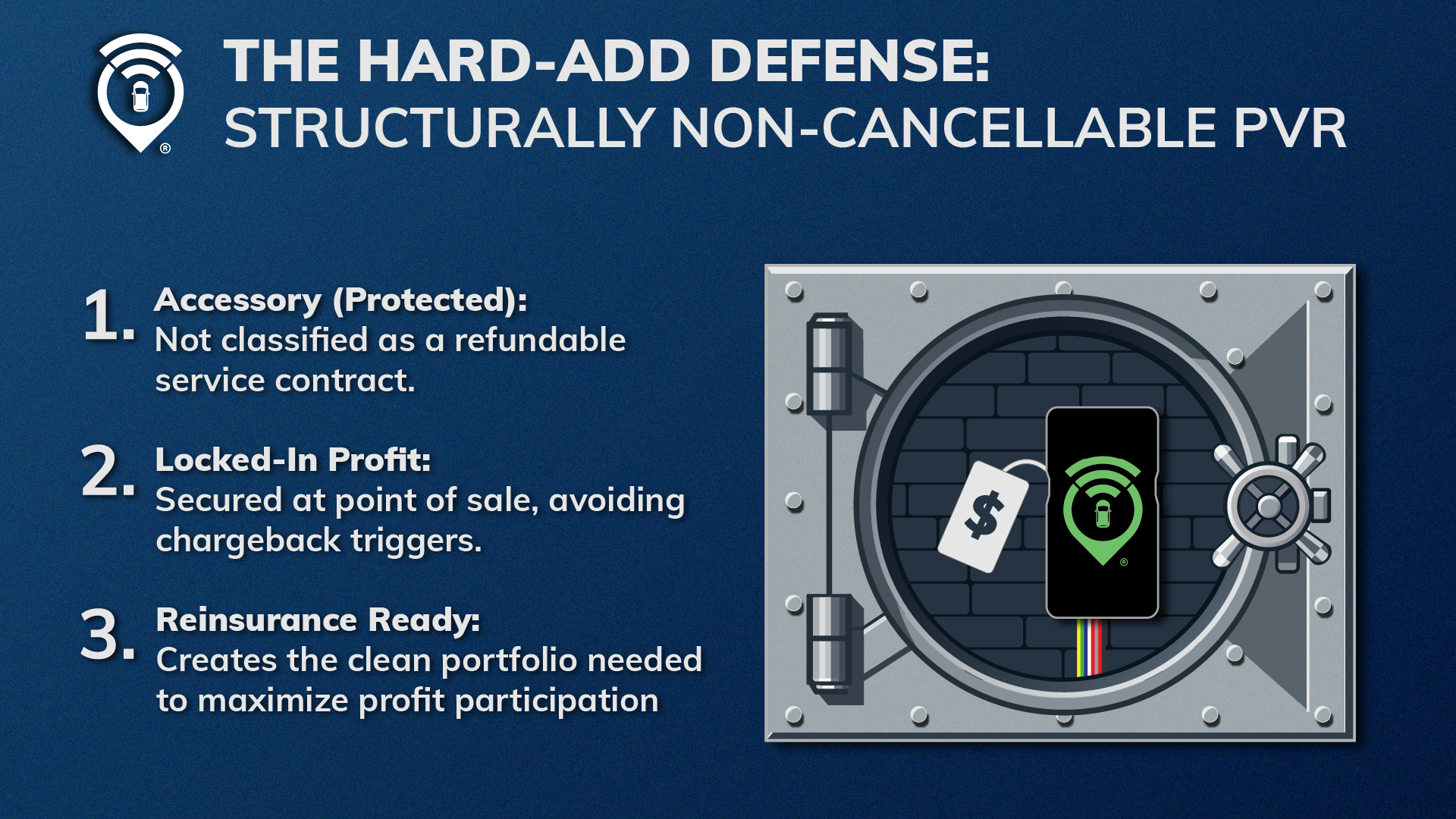

Ikon Technologies bypasses the chargeback threat by avoiding the legal classification that mandates consumer refunds.

The key distinction is simple: Ikon is designed and installed as a Permanent Accessory or a Dealer-Installed Option - a Hard-Add - on the vehicle sales addendum.

Unlike a VSC, which is a promise of future service, Ikon is a physical, installed asset that provides a lifetime of data and security services. The physical installation is your legal firewall. Once the primary vehicle purchase contract is signed, the revenue is instantly realized and is structurally protected from cancellation mandates.

This means Ikon’s PVR contribution is:

- Instant: Locked into your front-end gross at the point of sale.

- Secure: Protected from Early Payoff, Trade-In Other Dealer, and other common chargeback triggers.

The Compliance Firewall: Navigating Refund Mandates

If a product can survive the stringent consumer protection laws of California, it can survive anywhere. California Civil Code Section 1794.41 requires nearly all service contracts be cancellable and subject to a pro-rated refund.

Ikon maintains its non-cancellable structure in these stringent markets by adhering to critical operational and legal safeguards:

- Accessory Documentation: The product is strictly documented, marketed, and itemized as an installed accessory, avoiding the statutory definition of a service contract that promises mechanical indemnity.

- Integrity and Risk Mitigation: Ikon is SOC Compliant (a rarity in the automotive space) and integrates seamlessly with your DMS/Menu systems. Critically, the technology is designed to automatically disable tracking if the customer declines the purchase, preventing high-risk privacy violations and shielding the dealer from legal exposure often scrutinized in California.

This design solidifies a legally sound foundation for non-cancellable PVR.

Reinsurance and the Loyalty Mandate

The stable, non-cancellable PVR Ikon generates is more than revenue protection, it is the capital that fuels whole-store growth and enhances your financial structure:

- Maximize Reinsurance Profit: Because the structural risk of chargeback cancellation is removed, you are better positioned to utilize attractive reinsurance options with confidence, maximizing the capture of underwriting profit through your captive program.

- Guaranteed Repurchase Loyalty: The $10,000 consumer limited theft warranty includes an $8,000 credit toward a replacement vehicle, specifically conditioned on the customer returning to the original dealer. This is a contractual mechanism to guarantee future business.

- Service Absorption: Ikon’s Service Center and patented Smart Marketing services are part of the Ikon Program. We text and call your customers, producing a consistent 12% conversion rate on service reminders and driving 50–125 additional Repair Orders (ROs) monthly, significantly boosting high-margin Customer Pay RO Count.

Conclusion: Your Revenue Protection Policy

Your dealership needs predictable revenue to drive LTV and navigate market volatility. By integrating the Ikon Hard-Add accessory, your F&I department stops hemorrhaging profits to chargebacks and establishes the secure, predictable foundation required to fund your entire customer retention cycle. Ikon is the essential revenue protection policy for your dealership's financial future.

- In today's world, everything you can do to improve profitability is critical. Call or write us today to find out how we can help.